A government official calls. You’re alarmed; what have you done?

The conversation raises concerns. Suspicious transactions have been made with your bank account for criminal activities.

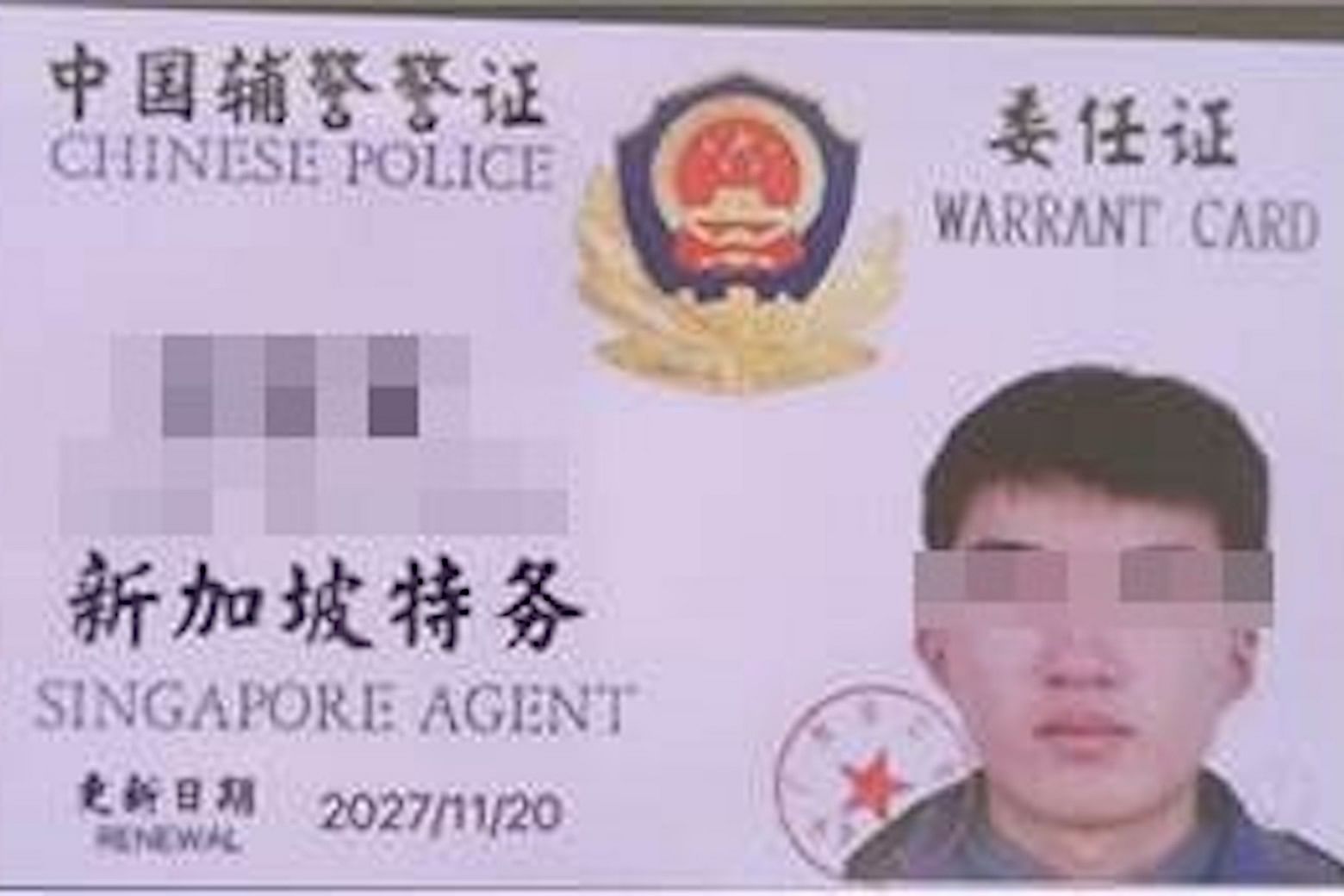

What happens next is distressing; scammers, posing as either local or foreign police officers, are now on the other end of the line.

You’re involved in criminal activity, they claim. Cooperate to resolve your case, they order.

How to identify the ruse, known as a government official impersonation scam?

“No government official will ask you to transfer money over a call, via message or social media platforms,” says Police Superintendent Rosie Ann McIntyre, assistant director of the Scam Public Education Office Operations Department, Singapore Police Force (SPF).

“Nobody should be asking you for your personal banking details and one-time passwords (OTPs). If you receive such requests, it’s most likely to be a scam,” she adds.

Three recent cases show how victims were deceived by scammers posing as government officials.

How it happened

Case 1: A 19-year-old woman received calls from scammers posing as officials from the Immigration and Checkpoints Authority and China Police on Oct 31, 2023.

She was led to believe that she was involved in money laundering activities in China. On the pretext of raising bail and to resolve the case, the victim was told to transfer more than $230,000 to the scammers’ bank accounts.

She was then asked to record a video of herself pretending to be captured to help promote scam awareness. The video was later used by the scammers to threaten her parents, based in China, and to demand ransom.

Two male suspects, aged 21 and 25, were arrested by the SPF in January.

Case 2: In November 2023, a 79-year-old woman was instructed by a scammer, posing as an SPF official, to liquidate her unit trust investments and transfer the funds to a third-party bank account. She was told that the money was needed to assist in investigations.

The anti-fraud team of the victim’s bank worked with SPF’s Anti-Scam Centre (ASC) to trace the funds, and identify and freeze the scammer's bank accounts. It prevented the loss of over $260,000.

Case 3: A scammer posing as a China Police officer accompanied a male victim, 82, to his bank on March 9 to purchase a cashier’s order of $1.2 million for a fraudulent transaction.

The attempt was intercepted by the staff of the victim’s bank and the ASC. The 20-year-old suspect was arrested.

Be wary of such scams, says Police Superintendent McIntyre. “Overseas law enforcement agencies have no jurisdiction to conduct operations in Singapore, arrest anyone or ask members of the public to help with any form of investigations without the approval of the Singapore Government.

“If an overseas law enforcement officer is ordering you to do things in Singapore from overseas under the colour of their national office, hang up the call and check with the SPF.”

Your CPF could be at risk, too

While bank savings are the typical target for government official impersonation scams, your retirement funds could also be at risk. Across three cases last December, victims withdrew and lost about $488,000 of their Central Provident Fund (CPF) savings.

Why CPF savings? “The amount in CPF balances tends to be more substantial for most people,” says Police Superintendent McIntyre, adding that seniors are most vulnerable to such scams.

Upon turning 55, CPF members can withdraw at least $5,000, or any excess amount after meeting the Full Retirement Sum (FRS), which increases yearly. For those turning 55 this year, the FRS is $205,800.

Police Superintendent McIntyre explains that in cases involving CPF withdrawals, scammers told victims to withdraw CPF monies into victims’ bank accounts, and subsequently instructed victims to make further transfers or provide banking credentials.

Protect yourself and your money

ADD ScamShield and security features

- Download ScamShield App to protect yourself from scam calls and SMSes.

- Set security features such as transaction limits for internet banking transactions, and enable two- or multi-factor authentication for banks and e-wallets.

- Consider Money Lock, International Call Blocking and CPF Withdrawal Lock options to further protect yourself against scams.

CHECK for scam signs with official sources

- No government official will ask you to transfer money over a call, via message or social media platforms.

- Never disclose your banking or credit card details, or OTPs to anyone.

- If an overseas law enforcement officer is ordering you to do things in Singapore under the colour of their national office, hang up the call and check with the SPF.

- Call the Anti-Scam Helpline at 1800-722-6688 when you are unsure if a situation you are facing is a scam.

TELL authorities, family, and friends

- Do not be pressured by the caller to act impulsively.

- Report any fraudulent transactions to your bank immediately and make a police report.

- Follow the National Crime Prevention Council ScamAlert WhatsApp channel to receive the latest anti-scam advisories and share them with your family and friends.

This is part of a series titled "Act against scams", in partnership with the Singapore Police Force.